|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

How Do You Qualify for Chapter 7 Bankruptcy: A Comprehensive Guide

Filing for Chapter 7 bankruptcy can be a complex decision, but understanding the qualification requirements can help simplify the process. This guide will walk you through the key factors that determine eligibility for Chapter 7 bankruptcy.

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as liquidation bankruptcy, allows individuals to discharge most of their debts, giving them a fresh financial start. It's crucial to meet certain criteria to qualify for this type of bankruptcy.

Eligibility Requirements

1. Means Test

The primary qualification for Chapter 7 bankruptcy is passing the means test. This test compares your income to the median income of a similar household in your state.

- If your income is below the median, you automatically qualify.

- If your income is above the median, further calculations are needed to determine disposable income.

2. Income Threshold

To qualify, your disposable income should be low enough to prevent any substantial repayment to creditors. It's recommended to consult a bankruptcy attorney in Baton Rouge for precise evaluations.

Additional Considerations

3. Credit Counseling Requirement

Applicants must complete a credit counseling course from an approved agency within 180 days before filing.

4. Previous Bankruptcy Discharge

If you have received a bankruptcy discharge in the past, you must wait a certain period before you can file again for Chapter 7.

- Eight years if your previous discharge was under Chapter 7.

- Six years if your previous discharge was under Chapter 13.

Common Misunderstandings

Many people think they need to be completely destitute to file for Chapter 7 bankruptcy, but that's not the case. It's about whether your current financial situation allows you to realistically repay your debts.

Seeking Professional Guidance

Given the complexities of bankruptcy laws, obtaining professional guidance is crucial. You might consider services like low-cost bankruptcy filing to ensure proper compliance and maximized benefits.

FAQ

What is the means test for Chapter 7 bankruptcy?

The means test determines if your income is low enough to qualify for Chapter 7 bankruptcy. It compares your income to the state median and examines disposable income.

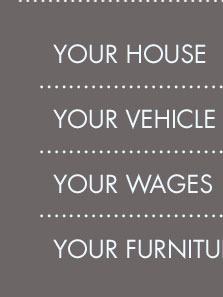

Can I keep any assets in Chapter 7 bankruptcy?

Yes, certain exemptions allow you to keep specific assets like your home or car, depending on state laws and the value of the property.

How often can you file for Chapter 7 bankruptcy?

You can file for Chapter 7 bankruptcy every eight years from the date of your last Chapter 7 discharge.

Essentially, you need to have three things: (1) moderate to low income, (2) significant amount of debt and (3) no substantial property.

If the debtor's income is below the median listed above for the states listed above (each state has its own requirements), the debtor is eligible for chapter 7 ...

Chapter 7 Checklist (Individual) - Voluntary Petition for Individuals Filing for Bankruptcy (Signed) - Initial Statement About an Eviction Judgment Against You ( ...

![]()